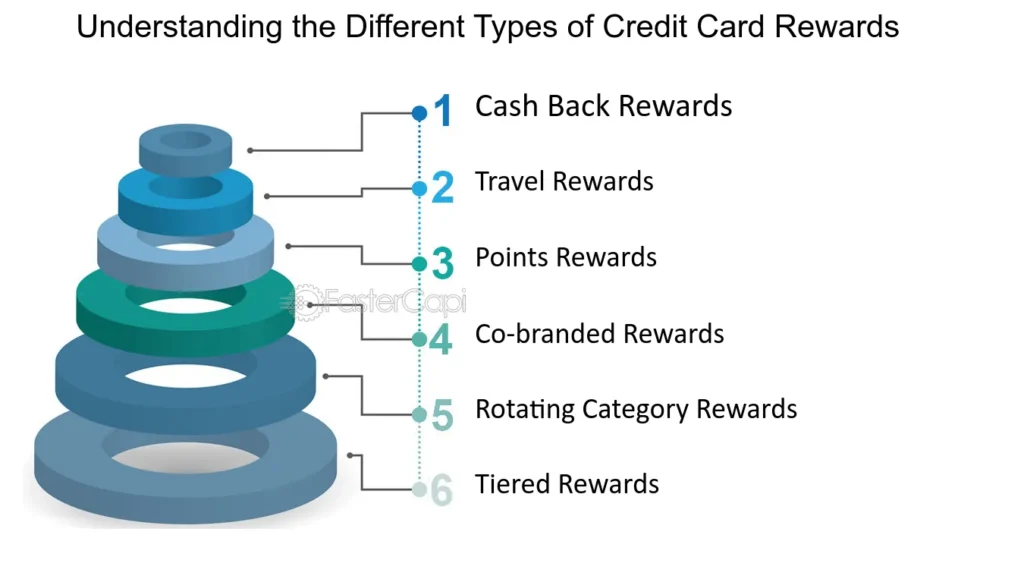

When it comes to credit cards, rewards programs can be your best friend. They allow you to earn something back for your everyday spending, whether that’s cash, points, or miles. But not all rewards credit cards are the same. In fact, they typically fall into two main categories: cash-back rewards and travel rewards. Each type offers distinct benefits depending on your spending habits and lifestyle. Let’s break down these two categories to help you decide which one fits your needs. thetravelsguide24 best credit card

1. Cash-Back Rewards Cards: Simple and Straightforward

If you’re looking for simplicity, cash-back rewards cards are the way to go. Every time you make a purchase, you earn a percentage of your spending back in cash. The rewards can often be used to pay off your balance, fund your savings, or even treat yourself to something special. best credit card

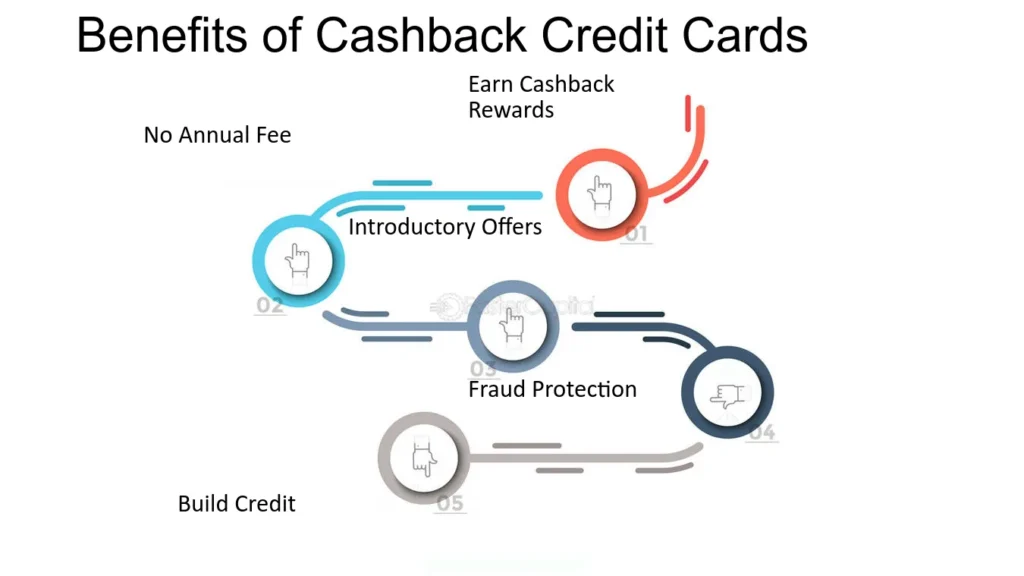

Key Benefits of Cash-Back Cards:

Easy Redemption: Cash-back is straightforward—you don’t have to worry about blackout dates, finding flights, or converting points. It’s cash, and you can use it however you want.

Flat-Rate or Bonus Categories: Some cards offer a flat-rate cash back on all purchases (like 1.5% or 2%), while others offer higher rates in specific categories such as groceries, dining, or gas.

No Need for Travel: If you’re not a frequent traveler, cash-back cards are often more useful, as you can still get rewards for your day-to-day purchases.

No Annual Fees (in many cases): Many cash-back credit cards don’t charge an annual fee, which means you get to keep 100% of your rewards. best credit card

Who Should Get a Cash-Back Card?

People who spend a lot on everyday categories like groceries, gas, or dining out.

Consumers who don’t travel frequently or want simple, easy-to-redeem rewards.

Popular options like the Citi Double Cash or Discover it Cash Back card offer excellent cash-back rewards with no fuss, making them ideal for shoppers who want a simple return on their spending.

2. Travel Rewards Cards: Maximizing Your Adventures

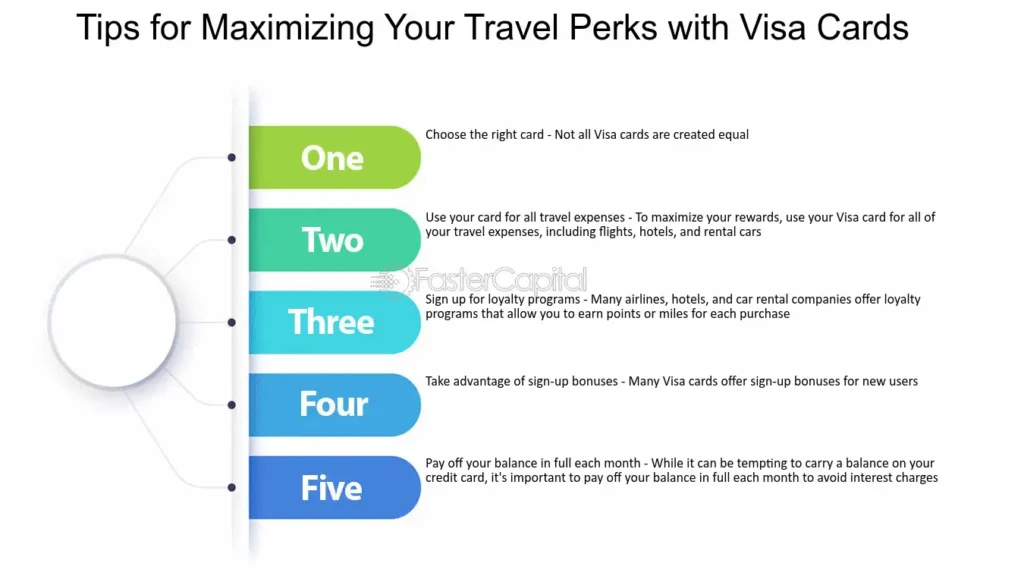

For those with wanderlust, travel rewards credit cards offer perks that make your trips more affordable and luxurious. Instead of earning cash, you’ll earn points or miles that can be redeemed for flights, hotel stays, and other travel expenses.

Key Benefits of Travel Rewards Cards:

Airline and Hotel Perks: Many travel cards are tied to specific airlines or hotel chains and can unlock perks like priority boarding, free checked bags, and room upgrades.

Earn Free Flights or Hotel Stays: Travel rewards can help you save big on your vacations. Depending on your spending, you could earn enough points for free trips, especially if you capitalize on sign-up bonuses.

Transferable Points: Some travel cards allow you to transfer points to airline or hotel loyalty programs, giving you flexibility to get the best deal when booking trips.

Extra Travel Perks: High-end travel cards often offer access to airport lounges, travel insurance, or credits for TSA PreCheck or Global Entry.

Who Should Get a Travel Rewards Card?

Those who enjoy luxury travel perks like lounge access, free upgrades, and priority boarding.

People who are savvy about booking travel during promotions to maximize their points.

Cards like the Chase Sapphire Preferred or American Express Platinum offer substantial travel perks and can help you turn your everyday spending into unforgettable experiences around the world. best credit card

Which One Is Right for You?

Choosing between cash-back and travel rewards cards boils down to how you spend your money and what you value most. If you prefer straightforward rewards you can use anytime, a cash-back card is probably your best bet. On the other hand, if you’re dreaming of vacations and enjoy leveraging points for flights or hotels, a travel rewards card could unlock incredible experiences for you. best credit card

Ultimately, both categories can help you make the most of your spending, and some consumers even carry one of each! This way, you can enjoy the best of both worlds—cash-back for everyday purchases and points or miles for your travels.

For more tips on maximizing your rewards, check out other helpful guides on The Travels Guide 24.